Top Guidelines Of Clark Wealth Partners

Wiki Article

Little Known Questions About Clark Wealth Partners.

Table of ContentsWhat Does Clark Wealth Partners Do?Clark Wealth Partners Fundamentals ExplainedThe 45-Second Trick For Clark Wealth PartnersThe Ultimate Guide To Clark Wealth Partners8 Easy Facts About Clark Wealth Partners ShownFascination About Clark Wealth Partners3 Simple Techniques For Clark Wealth PartnersThe smart Trick of Clark Wealth Partners That Nobody is Talking About

Common factors to consider an economic advisor are: If your economic scenario has ended up being extra complicated, or you do not have confidence in your money-managing abilities. Saving or browsing major life occasions like marriage, separation, kids, inheritance, or job modification that might substantially influence your financial scenario. Browsing the transition from conserving for retired life to maintaining wide range during retirement and exactly how to develop a strong retirement earnings strategy.New modern technology has actually led to more comprehensive automated economic tools, like robo-advisors. It's up to you to check out and determine the ideal fit - https://peatix.com/user/28420248/view. Ultimately, a good financial expert needs to be as mindful of your investments as they are with their very own, avoiding too much costs, conserving money on tax obligations, and being as clear as possible regarding your gains and losses

Some Known Questions About Clark Wealth Partners.

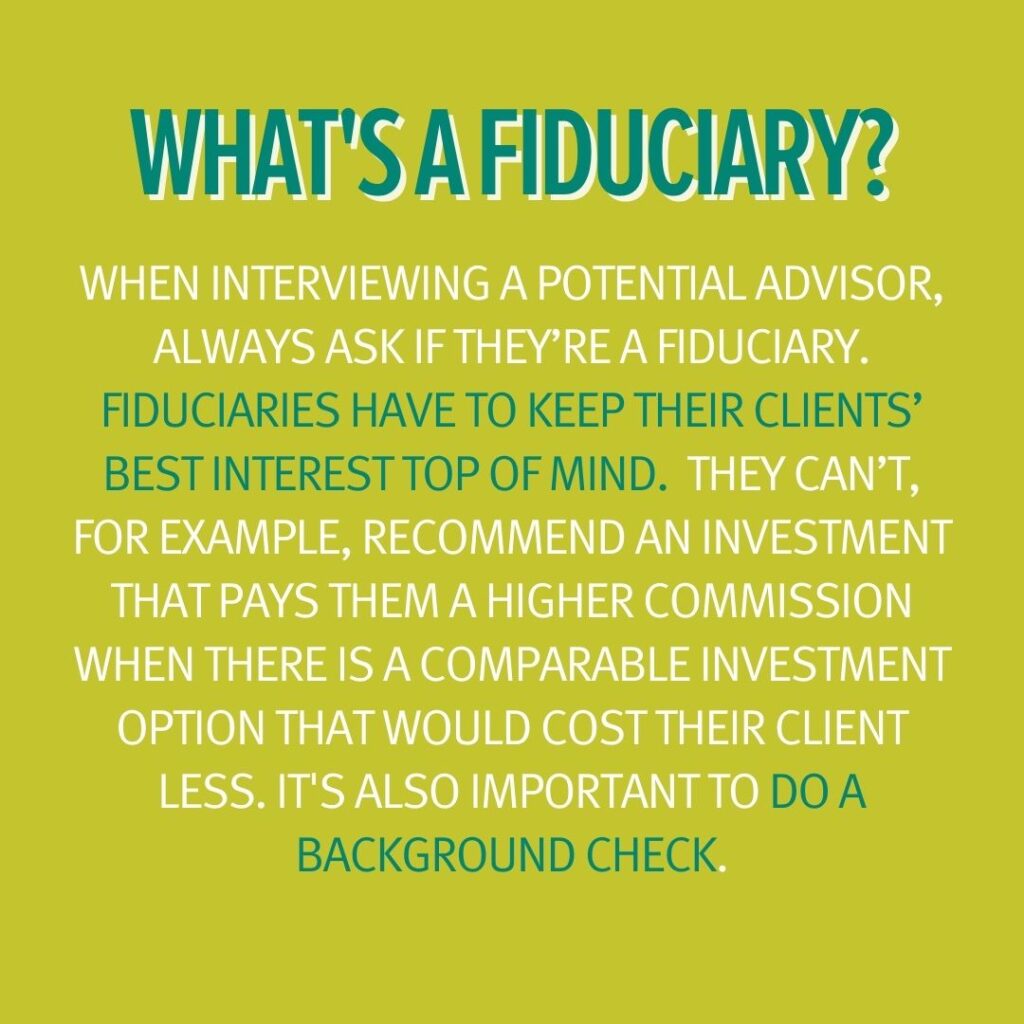

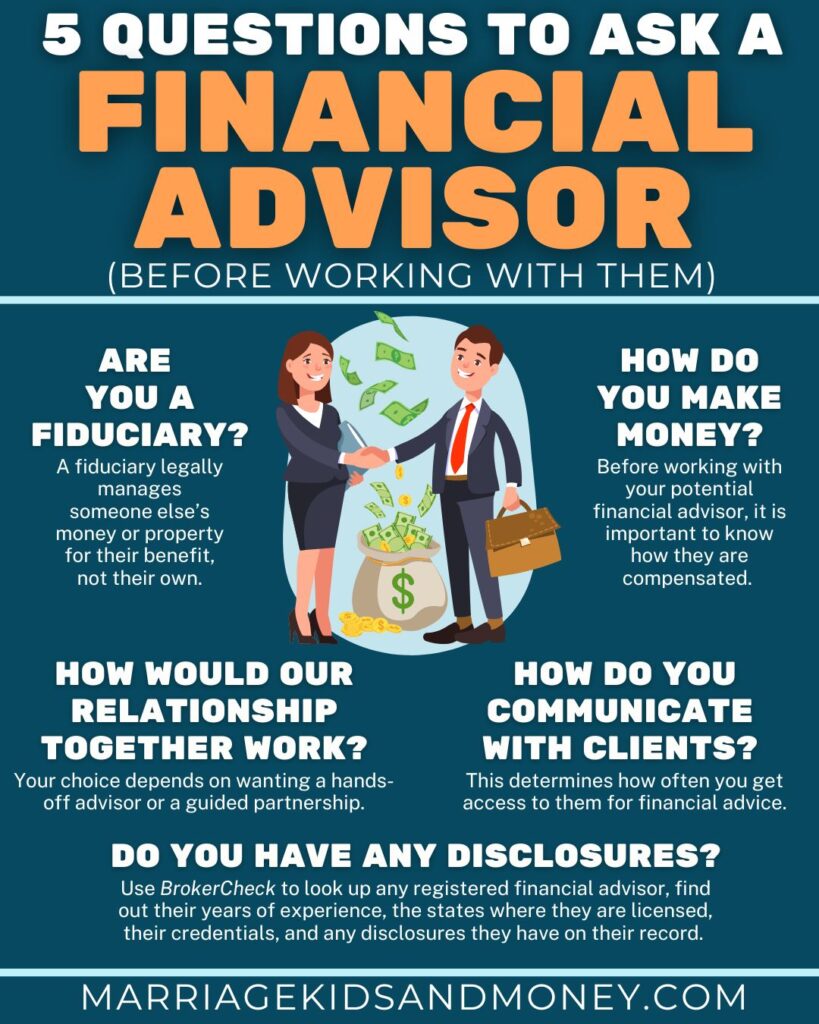

Earning a payment on product referrals does not always mean your fee-based consultant works versus your ideal passions. But they might be more likely to recommend product or services on which they earn a commission, which may or may not be in your benefit. A fiduciary is lawfully bound to place their customer's interests.They might comply with a freely kept an eye on "viability" requirement if they're not signed up fiduciaries. This common allows them to make referrals for financial investments and services as long as they fit their client's objectives, danger resistance, and economic situation. This can translate to suggestions that will also make them cash. On the various other hand, fiduciary consultants are legally obliged to act in their customer's finest interest rather than their very own.

The Best Guide To Clark Wealth Partners

ExperienceTessa reported on all things investing deep-diving into intricate financial topics, losing light on lesser-known investment avenues, and uncovering methods viewers can function the system to their advantage. As a personal money specialist in her 20s, Tessa is acutely familiar with the effects time and unpredictability have on your investment choices.

It was a targeted advertisement, and it functioned. Check out much more Review much less.

How Clark Wealth Partners can Save You Time, Stress, and Money.

There's no solitary path to turning into one, with some individuals starting in financial or insurance, while others begin in accountancy. 1Most financial coordinators start with a bachelor's degree in financing, business economics, accounting, company, or a relevant topic. A four-year level gives a solid structure for careers in investments, budgeting, and customer service.

The 3-Minute Rule for Clark Wealth Partners

Typical examples consist of the FINRA Collection 7 and Collection 65 examinations for safeties, or a state-issued insurance permit for offering life or medical insurance. While qualifications might not be legitimately required for all intending roles, companies and clients often view them as a criteria of professionalism. We look at optional qualifications in the next section.Most financial organizers have 1-3 years of experience and knowledge with monetary products, compliance criteria, and direct client communication. A solid educational history is essential, yet experience shows the ability to apply theory in real-world setups. Some programs integrate both, permitting you to complete coursework while making monitored hours via internships and practicums.

Clark Wealth Partners Things To Know Before You Buy

Very early years can bring lengthy hours, pressure to construct a client base, and the demand to continuously prove your expertise. Financial organizers delight in the possibility to function closely with customers, Learn More Here guide important life choices, and typically accomplish versatility in timetables or self-employment.

They invested less time on the client-facing side of the sector. Almost all financial supervisors hold a bachelor's degree, and lots of have an MBA or comparable graduate level.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

Optional certifications, such as the CFP, usually require added coursework and screening, which can prolong the timeline by a number of years. According to the Bureau of Labor Statistics, individual financial consultants gain a median yearly yearly income of $102,140, with top income earners earning over $239,000.In various other provinces, there are policies that need them to fulfill specific demands to make use of the financial consultant or monetary coordinator titles (financial advisor st. louis). What establishes some monetary advisors in addition to others are education and learning, training, experience and credentials. There are numerous classifications for monetary advisors. For monetary organizers, there are 3 common designations: Certified, Personal and Registered Financial Coordinator.

Clark Wealth Partners Things To Know Before You Buy

Those on wage may have an incentive to advertise the items and solutions their companies supply. Where to discover an economic expert will depend on the sort of guidance you need. These organizations have personnel who may assist you recognize and purchase certain sorts of financial investments. Term deposits, assured financial investment certifications (GICs) and mutual funds.Report this wiki page